Risks of Lending to Companies Located in Areas of Social Tension

Issuing loans to firms based in regions of unrest looks profitable at first glance. Lower wages, strong demand for capital, and access to underdeveloped markets create the impression of high potential. Yet beneath these numbers lies a fragile reality. Protests, strikes, ethnic disputes, or sudden political decisions can bring operations to a standstill overnight. For banks and investors, this makes lending in such regions less a matter of evaluating balance sheets and more about measuring the durability of local stability. Profitable projects may collapse quickly if unrest spills into streets, workplaces, or supply chains.

Credit Risk in Volatile Environments

Traditional credit risk focuses on whether a borrower can generate enough revenue to repay. In areas of social tension, this risk is compounded by unpredictable external shocks. A factory may have strong demand and healthy margins, but if its workforce walks out in protest, production halts and cash flow dries up. Strikes, local blockades, or sudden political crackdowns distort repayment capacity. Standard financial models often fail to capture these shocks, leaving lenders unprepared. The absence of political and social variables in credit scoring makes these loans look safer on paper than they are in practice.

Why Conventional Risk Models Fail

Credit scoring systems prioritize historical data and forecasts. But unrest often arises without warning, triggered by rising prices, election disputes, or labor demands. This unpredictability means that models built on past performance overlook the possibility of sudden collapse. For example, a mining operation may deliver profits for years until a local community demands higher compensation, shutting production. The inability to anticipate non-financial triggers shows the limits of conventional analysis. To protect themselves, lenders must supplement credit checks with political and social monitoring.

Operational Disruptions for Borrowers

Unrest affects companies directly and indirectly. Facilities may be damaged, deliveries interrupted, or employees unable to travel safely. Even if assets remain intact, perception of insecurity can reduce productivity. Workers avoid risky zones, international buyers redirect orders, and insurers raise premiums. The result is a decline in performance that quickly undermines repayment capacity. In some cases, firms must temporarily shut down, which erodes working capital and forces them to delay or renegotiate loans. For lenders, every day of lost production represents a step closer to default.

| Type of Risk | Impact on Companies | Consequence for Lenders |

|---|---|---|

| Strikes | Production halts, missed orders | Delayed repayments |

| Violent Protests | Asset damage, increased insurance costs | Higher default risk |

| Transport Blockades | Export delays, supply shortages | Loan restructuring needs |

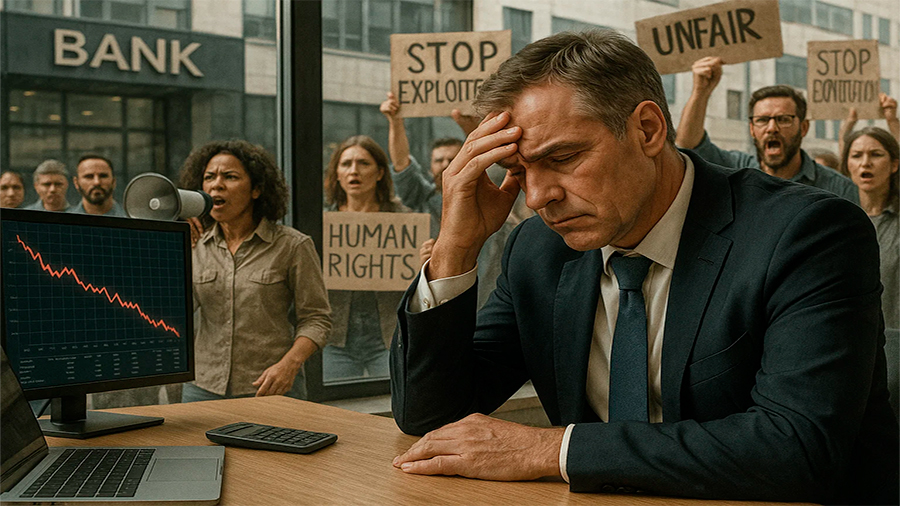

Reputation Risks for Lenders

Supporting companies in conflict-prone zones is not invisible. Civil society groups and journalists monitor financial flows closely. Even if loans are legal, association with companies accused of exploiting workers or ignoring community grievances can harm a bank’s brand. Global investors increasingly value responsible lending, and reputational damage reduces trust. A loan that looks profitable today may cost much more tomorrow if linked to controversy. Protecting credibility requires not just monitoring financial indicators but also evaluating whether the borrower’s practices align with social and labor standards.

Transparency as a Defense

Banks can mitigate reputational harm by demanding transparency. Borrowers should disclose how they engage with workers and communities. Development banks already require environmental and social impact assessments before financing projects. Private lenders that adopt similar standards signal responsibility to shareholders and clients. This doesn’t eliminate unrest, but it reduces accusations that banks fuel harmful practices. Transparent lending is increasingly seen not just as ethical, but as practical risk management.

Financial Impacts of Social Unrest

When social tension escalates, costs are immediate. A day of strike reduces output, disrupts cash flow, and weakens debt servicing capacity. Losses compound when supply chains are blocked or goods are damaged. Some firms may withstand a week of disruption; others collapse after only a few days. Lenders exposed to borrowers in these regions need detailed scenarios to predict financial losses and repayment delays. The impact is not theoretical—companies regularly request loan restructuring when unrest hits, leaving lenders to absorb delays or even write-offs.

| Scenario | Estimated Company Loss | Lender Impact |

|---|---|---|

| One-week strike | $400,000 in lost revenue | 30–45 days repayment delay |

| Two-week blockade | $1.5 million missed exports | Loan restructuring needed |

| Protest with asset damage | $4 million replacement cost | High risk of default |

Regional Case Studies

Examples from around the world highlight how fragile social environments affect lending. In Latin America, mining companies in Peru and Chile have faced prolonged strikes that slashed export revenues and triggered payment delays. In Nigeria’s oil-rich Niger Delta, sabotage and community protests have led to shutdowns that caused billions in losses for companies and their financiers. In South Asia, garment factories hit by political unrest lost international orders, weakening their ability to pay creditors. These situations underline that lenders cannot rely solely on macroeconomic growth; local grievances shape whether loans succeed or fail.

Industry-Specific Vulnerabilities

Some industries are more exposed than others. Natural resource firms often face community disputes over land or environmental damage. Manufacturing plants risk labor strikes over working conditions. Logistics companies operating in conflict zones face road blockades and theft. The sector matters as much as the location—lenders must understand both to price risk realistically. Ignoring these vulnerabilities increases the chance of misjudging loan quality.

Strategies for Risk Mitigation

Reducing exposure requires proactive measures. Political risk insurance helps cover losses from unrest. Co-financing with development banks shares risk in volatile areas. Diversifying loan portfolios prevents overexposure to a single region. Beyond financial tools, lenders can insist borrowers adopt stronger labor standards, engage with communities, and improve transparency. Linking loans to social compliance creates incentives for firms to reduce tensions proactively. Higher interest rates may compensate for added risk, but they can also make credit less accessible. Balancing protection with fairness remains a central challenge for lenders.

| Strategy | Mechanism | Benefit for Lenders |

|---|---|---|

| Political Risk Insurance | Covers unrest-related defaults | Lower exposure |

| Co-financing | Shared lending with multilateral banks | Risk diversification |

| Social Compliance Clauses | Borrowers must meet labor and community standards | Reduced reputational damage |

The Conclusion

Lending to companies in unstable regions combines financial promise with elevated risks. Credit, operational, reputational, and political factors converge to make repayment less predictable than standard models assume. Examples from Latin America, Africa, and Asia demonstrate how unrest disrupts revenues, damages assets, and undermines lenders. Mitigation requires more than higher interest rates—it requires transparency, risk-sharing mechanisms, and attention to local social dynamics. For lenders, the decision is not just about financial return but also about navigating the fine balance between opportunity and vulnerability.