How Social Networks Influence the Desire to Take Out a Loan: The Effect of Digital Pressure

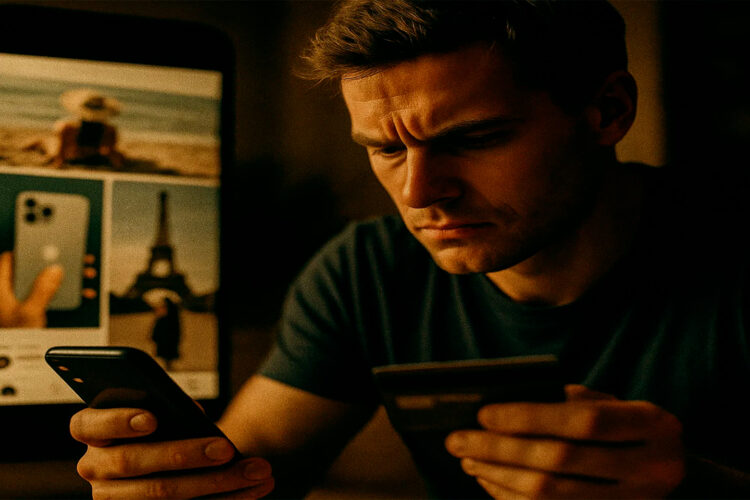

Open any feed and you’ll see it: friends on a beach, a co-worker’s new phone, an influencer’s “casual” weekend in Paris. Social networks turn everyday scrolling into a steady stream of lifestyles—some real, some carefully staged. The result is subtle pressure. If they have it, why don’t I? For many, credit fills that gap. Platforms don’t just shape opinions; they nudge financial choices. Borrowing becomes a quick fix to match what’s on screen, even when a budget says “not now.”

Social Media and the Psychology of Borrowing

Loans rarely start in a bank branch anymore. They start with a swipe. Algorithms prioritize posts that spark emotion—envy, excitement, aspiration—which also drive spending. When that emotion meets instant credit offers, the leap from “want” to “buy” takes seconds. That’s the new pipeline from post to purchase, and often, to debt.

Comparison as a Financial Trigger

Comparison is old; social media scales it. You’re no longer measuring against a few neighbors—you’re comparing with hundreds of polished, filtered lives. This raises the “normal” bar. A trip looks like a routine weekend. A premium device looks like a standard tool. Credit cards and “pay-in-4” plans step in to keep up. The danger isn’t the one-off splurge; it’s how repeat comparison normalizes borrowing for non-essentials.

The Dopamine Effect and Instant Gratification

Likes deliver small dopamine hits. So does buying. Platforms fuse those hits: the scroll sparks desire, the checkout rewards it, the notification validates it. Loans and BNPL fit neatly into that loop by turning delayed ownership into instant access. The brain gets its reward now. The budget deals with it later.

The Role of Influencers in Shaping Borrowing Patterns

Influencers collapse the distance between advertising and everyday life. A sponsored post looks like a friend’s recommendation. A luxury product appears “attainable,” especially when split into monthly payments. The more aspirational the content, the more ordinary it feels to finance the look.

Marketing Disguised as Lifestyle

Brand trips, gifted items, and affiliate links blur the line between sharing and selling. Followers rarely see the cost behind the image. They just see the result. Availability bias kicks in: “Everyone has this now.” Credit becomes the bridge between that impression and reality.

Peer Validation as Pressure

Comments and hearts don’t just reward creators—they pressure viewers. People want the recognition that follows the purchase. Few posts show the bill or the repayment plan. The applause is public; the debt is private.

Lifestyle Pressure and Hidden Borrowing Risks

Digital culture rarely tells you to borrow directly—it normalizes a lifestyle that quietly requires it. Families upgrade cars sooner. Couples plan pricier trips. Students finance devices beyond need. It feels harmless until payments stack and flexibility disappears.

From Small Purchases to Big Commitments

Debt creep is real. It begins with headphones or shoes and scales up to furniture, renovations, and long trips. The pattern is the same: “It’s only X per month.” Ten small “X”s become a heavy fixed cost that crowds out savings.

The Rationalization Trap

“I’ll pay it off next month.” “My bonus will cover it.” “It’s an investment in my brand.” These thoughts feel reasonable in the moment and dangerous in a pattern. Algorithms won’t reduce the pressure; you have to build the brakes.

Data on Borrowing Behavior and Digital Pressure

Exposure doesn’t guarantee borrowing, but the link is strong enough to reshape credit markets and household budgets.

| Digital Trigger | Share of Users Affected | Typical Credit Response |

|---|---|---|

| Lifestyle posts from peers | ~45% | Credit card spend on travel/fashion |

| Influencer promotions | ~30–35% | Installment financing (BNPL) |

| One-click BNPL at checkout | ~25–30% | Short-term consumer loans |

| Comparison/FOMO | ~40% | Higher revolving balances |

Generational Differences in Digital Borrowing

Age shifts how people react to digital pressure. Younger users borrow more for visibility and experiences; older users borrow selectively for upgrades and comfort.

| Age Group | Influence Level | Common Borrowing Pattern |

|---|---|---|

| 18–29 | Very high | Loans for trips, gadgets, lifestyle brands |

| 30–44 | High | Credit for family travel, home tech, events |

| 45–60 | Moderate | Selective borrowing for renovations/cars |

| 60+ | Low | Minimal; focus on essentials and savings |

How Platforms and Lenders Tighten the Loop

Ads, creators, and credit now live in the same scroll. Platforms surface desires; lenders offer instant solutions. That fusion makes impulse finance easier than ever.

| Platform Pattern | Typical Lending Hook | Borrower Risk |

|---|---|---|

| Curated lifestyle reels | BNPL badges at checkout | Stacked micro-debts, low visibility |

| Influencer “must-have” drops | Instant-approval store cards | High utilization, fee exposure |

| Shoppable live streams | Embedded financing in-stream | Impulse purchases on credit |

Coping Strategies: Practical Ways to Push Back

You can’t control the algorithm, but you can control your response. Treat your feed like a storefront—curate it on purpose.

Set Clear Digital Boundaries

Mute high-pressure accounts. Hide shoppable posts. Turn off one-click payments. Reducing exposure cuts impulse spend more than willpower alone.

Budget for “Inspired” Buys

Create a small “inspired” line in your budget. If an item exceeds it, wait 7–14 days. Most wants fade; the good ones survive the cooling-off period.

Use Friction to Your Advantage

Remove saved cards. Disable autofill. Require two-step checkout. Friction slows the dopamine loop long enough for reason to re-enter the chat.

Be Open About Money

Talk with friends or family about budgets and limits. Shared honesty breaks the myth that everyone is effortlessly affording everything they post.

Beyond Individuals: How Lenders Respond

Banks and fintechs are watching the same patterns. Some now assess spending spikes around high-pressure events (big sales, travel seasons) when evaluating risk. Others raise limits for responsible users but tighten for accounts with growing BNPL stacks. Expect more scrutiny on revolving debt and impulse-heavy categories. That means digital borrowing habits can affect future interest rates and approvals.

Smarter Borrowing in a Social World

Credit isn’t the villain. Using it for skills, mobility, or durable comfort can be smart. The risk is borrowing driven by FOMO and filters. A simple rule helps: if it won’t matter in six months, don’t finance it for twelve. If it builds your future self, consider it; if it props up your online self, pause.

Conclusion

Social networks don’t issue loans, but they influence why we take them. Comparison, dopamine, and influencer marketing make quick credit feel normal—and necessary. You can’t turn off the internet, but you can turn down its pressure: curate your feed, add friction, budget for whims, and borrow only when it builds something that lasts. In the long run, financial calm beats digital applause every time.